Computer, Technology, Databases, Google, Internet, Mobile, Linux, Microsoft, Open Source, Security, Social Media, Web Development, Business, Finance

Tuesday, March 31, 2009

President Obama on Stabilizing the Auto Industry

Take note of Obama's definition of bankruptcy for the auto industry (10:00 onwards).

Fate of GM & Chrysler

Obama Administration on the auto industry:

And so today I'm announcing that my administration will offer GM and Chrysler a limited additional period of time to work with creditors, unions, and other stakeholders to fundamentally restructure in a way that would justify an investment of additional taxpayer dollars. During this period they must produce plans that would give the American people confidence in their long-term prospects for success.

Now, what we're asking for is difficult. It will require hard choices by companies. It will require unions and workers who have already made extraordinarily painful concessions to do more. It'll require creditors to recognize that they can't hold out for the prospect of endless government bailouts. It'll have to -- it will require efforts from a whole host of other stakeholders, including dealers and suppliers. Only then can we ask American taxpayers who have already put up so much of their hard-earned money to once more invest in a revitalized auto industry.

But I'm confident that if each are willing to do their part, if all of us are doing our part, then this restructuring, as painful as it will be in the short term, will mark not an end, but a new beginning for a great American industry -- an auto industry that is once more out-competing the world; a 21st century auto industry that is creating new jobs, unleashing new prosperity, and manufacturing the fuel-efficient cars and trucks that will carry us towards an energy-independent future. I am absolutely committed to working with Congress and the auto companies to meet one goal: The United States of America will lead the world in building the next generation of clean cars.

Obama Administration on General Motors (GM):

GM has made a good faith effort to restructure over the past several months -- but the plan that they've put forward is, in its current form, not strong enough. However, after broad consultation with a range of industry experts and financial advisors, I'm absolutely confident that GM can rise again, providing that it undergoes a fundamental restructuring. As an initial step, GM is announcing today that Rick Wagoner is stepping aside as Chairman and CEO. This is not meant as a condemnation of Mr. Wagoner, who's devoted his life to this company and has had a distinguished career; rather, it's a recognition that will take new vision and new direction to create the GM of the future.

In this context, my administration will offer General Motors adequate working capital over the next 60 days. And during this time, my team will be working closely with GM to produce a better business plan. They must ask themselves: Have they consolidated enough unprofitable brands? Have they cleaned up their balance sheets, or are they still saddled with so much debt that they can’t make future investments? Above all, have they created a credible model for how not only to survive, but to succeed in this competitive global market?

Obama Administration on Chrysler:

The situation at Chrysler is more challenging. It's with deep reluctance but also a clear-eyed recognition of the facts that we've determined, after careful review, that Chrysler needs a partner to remain viable. Recently, Chrysler reached out and found what could be a potential partner -- the international car company Fiat, where the current management team has executed an impressive turnaround. Fiat is prepared to transfer its cutting-edge technology to Chrysler and, after working closely with my team, has committed to build -- building new fuel-efficient cars and engines right here in the United States. We've also secured an agreement that will ensure that Chrysler repays taxpayers for any new investments that are made before Fiat is allowed to take a majority ownership stake in Chrysler.

Still, such a deal would require an additional investment of taxpayer dollars, and there are a number of hurdles that must be overcome to make it work. I'm committed to doing all I can to see if a deal can be struck in a way that upholds the interests of American taxpayers. And that's why we'll give Chrysler and Fiat 30 days to overcome these hurdles and reach a final agreement -- and we will provide Chrysler with adequate capital to continue operating during that time. If they are able to come to a sound agreement that protects American taxpayers, we will consider lending up to $6 billion to help their plan succeed. But if they and their stakeholders are unable to reach such an agreement, and in the absence of any other viable partnership, we will not be able to justify investing additional tax dollars to keep Chrysler in business.

GM & Chrysler [via]

And so today I'm announcing that my administration will offer GM and Chrysler a limited additional period of time to work with creditors, unions, and other stakeholders to fundamentally restructure in a way that would justify an investment of additional taxpayer dollars. During this period they must produce plans that would give the American people confidence in their long-term prospects for success.

Now, what we're asking for is difficult. It will require hard choices by companies. It will require unions and workers who have already made extraordinarily painful concessions to do more. It'll require creditors to recognize that they can't hold out for the prospect of endless government bailouts. It'll have to -- it will require efforts from a whole host of other stakeholders, including dealers and suppliers. Only then can we ask American taxpayers who have already put up so much of their hard-earned money to once more invest in a revitalized auto industry.

But I'm confident that if each are willing to do their part, if all of us are doing our part, then this restructuring, as painful as it will be in the short term, will mark not an end, but a new beginning for a great American industry -- an auto industry that is once more out-competing the world; a 21st century auto industry that is creating new jobs, unleashing new prosperity, and manufacturing the fuel-efficient cars and trucks that will carry us towards an energy-independent future. I am absolutely committed to working with Congress and the auto companies to meet one goal: The United States of America will lead the world in building the next generation of clean cars.

Obama Administration on General Motors (GM):

GM has made a good faith effort to restructure over the past several months -- but the plan that they've put forward is, in its current form, not strong enough. However, after broad consultation with a range of industry experts and financial advisors, I'm absolutely confident that GM can rise again, providing that it undergoes a fundamental restructuring. As an initial step, GM is announcing today that Rick Wagoner is stepping aside as Chairman and CEO. This is not meant as a condemnation of Mr. Wagoner, who's devoted his life to this company and has had a distinguished career; rather, it's a recognition that will take new vision and new direction to create the GM of the future.

In this context, my administration will offer General Motors adequate working capital over the next 60 days. And during this time, my team will be working closely with GM to produce a better business plan. They must ask themselves: Have they consolidated enough unprofitable brands? Have they cleaned up their balance sheets, or are they still saddled with so much debt that they can’t make future investments? Above all, have they created a credible model for how not only to survive, but to succeed in this competitive global market?

Obama Administration on Chrysler:

The situation at Chrysler is more challenging. It's with deep reluctance but also a clear-eyed recognition of the facts that we've determined, after careful review, that Chrysler needs a partner to remain viable. Recently, Chrysler reached out and found what could be a potential partner -- the international car company Fiat, where the current management team has executed an impressive turnaround. Fiat is prepared to transfer its cutting-edge technology to Chrysler and, after working closely with my team, has committed to build -- building new fuel-efficient cars and engines right here in the United States. We've also secured an agreement that will ensure that Chrysler repays taxpayers for any new investments that are made before Fiat is allowed to take a majority ownership stake in Chrysler.

Still, such a deal would require an additional investment of taxpayer dollars, and there are a number of hurdles that must be overcome to make it work. I'm committed to doing all I can to see if a deal can be struck in a way that upholds the interests of American taxpayers. And that's why we'll give Chrysler and Fiat 30 days to overcome these hurdles and reach a final agreement -- and we will provide Chrysler with adequate capital to continue operating during that time. If they are able to come to a sound agreement that protects American taxpayers, we will consider lending up to $6 billion to help their plan succeed. But if they and their stakeholders are unable to reach such an agreement, and in the absence of any other viable partnership, we will not be able to justify investing additional tax dollars to keep Chrysler in business.

GM & Chrysler [via]

Free Conficker/Downadup Cleaning Tools

Free Conficker/Downadup Cleaning Tools:

- McAfee Stinger

- ESet EConfickerRemover

- Symantec W32.Downadup Removal Tool

- F-Secure F-Downadup, FSMRT, more tools

- BitDefender single PC and network removal tools

- Kaspersky KKiller

- Trend Micro

- BitDefender

- Symantec

Monday, March 30, 2009

Busted! Conficker's tell-tale heart uncovered

Security experts have made a breakthrough in their five-month battle against the Conficker worm, with the discovery that the malware leaves a fingerprint on infected machines which is easy to detect using a variety of off-the-shelf network scanners.

Busted! Conficker's tell-tale heart uncovered [via]

Busted! Conficker's tell-tale heart uncovered [via]

How to Calculate the Amount of Income Tax to Pay For?

I am posting this How-To because I had previously gave inaccurate advice on income tax calculation. This post should clarify all doubts.

Suppose your taxable income after minus relief is $40,000, the amount of income tax to pay for is as follows:

Based on the above table, you will need to pay $350 + (5.5% * 10,000) = $900.

Based on the above table, you will need to pay $350 + (5.5% * 10,000) = $900.

If you are eligible for the 20% one-time tax discount as announced during Budget 2009, your tax will be $720 instead.

Suppose your taxable income after minus relief is $40,000, the amount of income tax to pay for is as follows:

Based on the above table, you will need to pay $350 + (5.5% * 10,000) = $900.

Based on the above table, you will need to pay $350 + (5.5% * 10,000) = $900.If you are eligible for the 20% one-time tax discount as announced during Budget 2009, your tax will be $720 instead.

Sunday, March 29, 2009

KITARO - Matsuri

The below is one song I used to listen to when I study for exams during my poly days.

New Reserve Currency to Replace U.S. Dollar?

Proposals for creating a new global reserve currency to replace the U.S. dollar are gathering momentum but need further examination, Germany's development minister said on Friday.

New reserve currency idea needs work-German minister [via]

New reserve currency idea needs work-German minister [via]

Saturday, March 28, 2009

Google Gmail Contacts Go Standalone

Google Gmail contacts has gone standalone. To access Google Gmail Contacts, type http://www.google.com/contacts.

Earth Hour 2009

Earth Hour is on March 28th, 2009 at 8:30pm (local time). For 60 seconds, the action needed is to turn off the lights or more if you want to save mother Earth.

Earth Hour is on March 28th, 2009 at 8:30pm (local time). For 60 seconds, the action needed is to turn off the lights or more if you want to save mother Earth.Earth Hour in Singapore [via]

Thursday, March 26, 2009

Candidates@Google: Barack Obama

Illinois Senator and 2008 Democratic presidential hopeful Barack Obama visits Google's Mountain View, CA, headquarters to deliver his innovation agenda, speak with Google CEO Eric Schmidt, and take questions from Google employees. This event took place on November 14, 2007, as part of the Candidates@Google series.

Wednesday, March 25, 2009

April Fool's Day Virus

A new variant of WORM_Downad (aka Conficker) is expected to propagate on 1st April 2009. This worm exploits the weakness of Microsoft Windows Operating System including Windows Vista.

As a precaution, perform anti-virus definition update on 31st March 2009.

PC security forces face April 1 showdown with Conficker worm [via]

As a precaution, perform anti-virus definition update on 31st March 2009.

PC security forces face April 1 showdown with Conficker worm [via]

U.K Primary School Pupils to study Twitter and Blogs

Children will no longer have to study the Victorians or the second world war under proposals to overhaul the primary school curriculum, the Guardian has learned.

However, the draft plans will require children to master Twitter and Wikipedia and give teachers far more freedom to decide what youngsters should be concentrating on in classes.

Pupils to study Twitter and blogs in primary schools shake-up [via]

However, the draft plans will require children to master Twitter and Wikipedia and give teachers far more freedom to decide what youngsters should be concentrating on in classes.

Pupils to study Twitter and blogs in primary schools shake-up [via]

Tuesday, March 24, 2009

Failing Economies of the Central and Eastern Europe

The below article is interesting. It talks about the economies of the Central and Eastern Europe failing and the possibility of they creating another huge crisis.

Don't Bail Out Eastern Europe [via]

Don't Bail Out Eastern Europe [via]

Monday, March 23, 2009

Fed move is a market-changer as the dollar sinks

The below article all the more reaffirms my earlier post on stocks being more attractive than treasuries.

Fed move is a market-changer as the dollar sinks [via]

Fed move is a market-changer as the dollar sinks [via]

Sunday, March 22, 2009

U.S. Treasuries Bubble?

The New York Times - March 22, 2009

The Way We Live Now

No Safety in Numbers

By ROGER LOWENSTEIN

Is there such a thing left as a safe investment? Stocks have been massacred, real estate all but wiped out. Each was promoted in its day — as was gold — as safe and secure, appropriate for widows and orphans.

If there is a truly last bastion of safety, it would be, of course, the U.S. Treasury bond, that venerable instrument with the full faith and credit of the United States behind it. Perhaps it is esteemed so highly because we think of it not as an “investment” per se but as an article of faith in Washington and, by extension, the entire country. It is our tax dollars, after all, that stand behind it — the accumulated output of our citizens. And ever since the Wall Street meltdown, as investors have fled from any security carrying a whiff of danger, Treasuries have been in hot demand.

So it is an eye-opener, and rather depressing, to report that even Treasuries bear risk, in particular, the risk that flows from crowd psychology. Last month, in his annual letter to shareholders (of which I am one), Warren Buffett wrote: “When the financial history of this decade is written, it will surely speak of the Internet bubble of the late 1990s and the housing bubble of the early 2000s. But the U.S. Treasury bond bubble of late 2008 may be regarded as almost equally extraordinary.”

Pretty strong words for an investment that has outperformed stocks over the past 25 years and is widely referred to as “riskless.” Yet according to Buffett and other investors of a cautious bent, “risk free” Treasuries of longer maturities are anything but. None other than China’s prime minister, Wen Jiabao, expressed worry about the safety of China’s big stake in U.S. bonds.

Not since World War II has the government borrowed anything close to what it is borrowing now. Because of the economic slowdown, the stimulus package and various financial-relief measures, pundits estimate this year’s federal deficit at $1.75 trillion. To put the figures in (alarming) perspective, over the past half century and regardless of the party in power, federal tax receipts have usually provided 80 to 90 percent of the money needed to fill the budget; thus, the government has had to borrow only the remaining fraction. But this year, it will need to borrow 45 percent, virtually half, of what it is projected to spend. This means that the U.S. government is looking much like a homeowner at the tail end of the boom: too hooked on spending (even if, hopefully, for a worthy cause) to stay within its means.

When you buy a Treasury security, you are actually lending the government money for a set period of time — from 30 days to 30 years — at a fixed rate of interest. Few people worry that Uncle Sam will go the way of a defaulting subprime borrower because the government, unlike other debtors, can always print the money it needs.

But as James Bianco, who runs an eponymous bond-research firm, explains, investors in fixed-income securities face two types of risk. One is credit risk — the risk of default. The other is what bond geeks refer to as “duration” risk. This is the risk that, even if the bonds are paid in full, the promised rate of interest will turn out to be worth less over time.

Inflation destroys bond values. It’s not a big deal over one or two years, but if you hold a long-term bond and inflation takes off, the present value of the security will plummet. Bonds also lose value as interest rates go up. If rates on 30-year U.S. bonds, recently 3 percent, were to rise to, say, 6 percent, the value of bonds issued at the lower rate would fall nearly in half. (The reason is largely intuitive: if the market rate is 6 percent, nobody would be interested in a 3 percent bond, and its price would fall.)

One thing that could make interest rates rise would be an economic recovery that spurred more firms to seek credit. That would be good news for the country, of course, but not for long-term bondholders. And it’s conceivable that rates on Treasuries could rise even without a strong recovery. Government budget deficits always bring a fear of higher rates (interest rates represent the price of credit, and deficits mean that the government will be demanding more of it). And given the looming shortfalls in Social Security and Medicare, it is not clear when the deficits will end.

Granted, Treasury bonds are not quite tulip bulbs or dot-com stocks. Investors purchase them out of fear, not greed. Presumably they are not doubling-down, buying Treasuries with borrowed money to juice profits. But that distinction may not save them.

Think of the yield on Treasuries as a reverse indicator of investor sentiment. The stronger the attachment people have for Treasuries, the more willing they are to accept a low return. Once the Wall Street crisis hit, investors traded what had been a strong attachment to Treasuries for downright love. Naturally enough, given this fearful ardor, the yield touched post-Depression lows.

As with any investment, generalized enthusiasm leads to frothy prices. In seeking safety, global investors pushed Treasuries to a vulnerable level. Bond-market optimists take comfort from the Federal Reserve Board, which has hinted that to keep interest rates from rising, it would be the lender of last resort. But were the Fed to absorb surplus Treasuries, the government would, in fact, merely be “printing money,” says Mohamed El-Erian, chief executive of the bond house Pimco. When the economy rebounds, such a scenario could lead to a textbook case of inflation and devastate the ultimate “safe” investment. And lately, bond rates have begun to rise.

The primary lesson of this crisis is that we, as a nation, took on too much risk — leveraging finite capital on a fantasy that no bet would ever go bad. But there’s another lesson, too. Even safety has its price, and if we overpay for it, we create new risks. Risk, in short, may be something we have to live with.

Roger Lowenstein, an outside director of the Sequoia Fund, is a contributing writer for the magazine.

Stocks could be more attractive than treasuries now.

The Way We Live Now

No Safety in Numbers

By ROGER LOWENSTEIN

Is there such a thing left as a safe investment? Stocks have been massacred, real estate all but wiped out. Each was promoted in its day — as was gold — as safe and secure, appropriate for widows and orphans.

If there is a truly last bastion of safety, it would be, of course, the U.S. Treasury bond, that venerable instrument with the full faith and credit of the United States behind it. Perhaps it is esteemed so highly because we think of it not as an “investment” per se but as an article of faith in Washington and, by extension, the entire country. It is our tax dollars, after all, that stand behind it — the accumulated output of our citizens. And ever since the Wall Street meltdown, as investors have fled from any security carrying a whiff of danger, Treasuries have been in hot demand.

So it is an eye-opener, and rather depressing, to report that even Treasuries bear risk, in particular, the risk that flows from crowd psychology. Last month, in his annual letter to shareholders (of which I am one), Warren Buffett wrote: “When the financial history of this decade is written, it will surely speak of the Internet bubble of the late 1990s and the housing bubble of the early 2000s. But the U.S. Treasury bond bubble of late 2008 may be regarded as almost equally extraordinary.”

Pretty strong words for an investment that has outperformed stocks over the past 25 years and is widely referred to as “riskless.” Yet according to Buffett and other investors of a cautious bent, “risk free” Treasuries of longer maturities are anything but. None other than China’s prime minister, Wen Jiabao, expressed worry about the safety of China’s big stake in U.S. bonds.

Not since World War II has the government borrowed anything close to what it is borrowing now. Because of the economic slowdown, the stimulus package and various financial-relief measures, pundits estimate this year’s federal deficit at $1.75 trillion. To put the figures in (alarming) perspective, over the past half century and regardless of the party in power, federal tax receipts have usually provided 80 to 90 percent of the money needed to fill the budget; thus, the government has had to borrow only the remaining fraction. But this year, it will need to borrow 45 percent, virtually half, of what it is projected to spend. This means that the U.S. government is looking much like a homeowner at the tail end of the boom: too hooked on spending (even if, hopefully, for a worthy cause) to stay within its means.

When you buy a Treasury security, you are actually lending the government money for a set period of time — from 30 days to 30 years — at a fixed rate of interest. Few people worry that Uncle Sam will go the way of a defaulting subprime borrower because the government, unlike other debtors, can always print the money it needs.

But as James Bianco, who runs an eponymous bond-research firm, explains, investors in fixed-income securities face two types of risk. One is credit risk — the risk of default. The other is what bond geeks refer to as “duration” risk. This is the risk that, even if the bonds are paid in full, the promised rate of interest will turn out to be worth less over time.

Inflation destroys bond values. It’s not a big deal over one or two years, but if you hold a long-term bond and inflation takes off, the present value of the security will plummet. Bonds also lose value as interest rates go up. If rates on 30-year U.S. bonds, recently 3 percent, were to rise to, say, 6 percent, the value of bonds issued at the lower rate would fall nearly in half. (The reason is largely intuitive: if the market rate is 6 percent, nobody would be interested in a 3 percent bond, and its price would fall.)

One thing that could make interest rates rise would be an economic recovery that spurred more firms to seek credit. That would be good news for the country, of course, but not for long-term bondholders. And it’s conceivable that rates on Treasuries could rise even without a strong recovery. Government budget deficits always bring a fear of higher rates (interest rates represent the price of credit, and deficits mean that the government will be demanding more of it). And given the looming shortfalls in Social Security and Medicare, it is not clear when the deficits will end.

Granted, Treasury bonds are not quite tulip bulbs or dot-com stocks. Investors purchase them out of fear, not greed. Presumably they are not doubling-down, buying Treasuries with borrowed money to juice profits. But that distinction may not save them.

Think of the yield on Treasuries as a reverse indicator of investor sentiment. The stronger the attachment people have for Treasuries, the more willing they are to accept a low return. Once the Wall Street crisis hit, investors traded what had been a strong attachment to Treasuries for downright love. Naturally enough, given this fearful ardor, the yield touched post-Depression lows.

As with any investment, generalized enthusiasm leads to frothy prices. In seeking safety, global investors pushed Treasuries to a vulnerable level. Bond-market optimists take comfort from the Federal Reserve Board, which has hinted that to keep interest rates from rising, it would be the lender of last resort. But were the Fed to absorb surplus Treasuries, the government would, in fact, merely be “printing money,” says Mohamed El-Erian, chief executive of the bond house Pimco. When the economy rebounds, such a scenario could lead to a textbook case of inflation and devastate the ultimate “safe” investment. And lately, bond rates have begun to rise.

The primary lesson of this crisis is that we, as a nation, took on too much risk — leveraging finite capital on a fantasy that no bet would ever go bad. But there’s another lesson, too. Even safety has its price, and if we overpay for it, we create new risks. Risk, in short, may be something we have to live with.

Roger Lowenstein, an outside director of the Sequoia Fund, is a contributing writer for the magazine.

Stocks could be more attractive than treasuries now.

Saturday, March 21, 2009

The Dangers of the Large Object Heap

An interesting article written on .NET garbage collector handling.

The Dangers of the Large Object Heap [via]

The Dangers of the Large Object Heap [via]

I Should be Contended With My Bonus

I just received my year end bonus for last Friday. After adding up January's 0.5 months bonus, National Day bonus and one-time quantum extra bonus, it sums up to approximately 2.6 months bonus. This excludes AWS and my $2,000 project bonus.

I thought I should be contended with what I am receiving and not grumble when my company announced freeze on wage increment days ago.

I thought I should be contended with what I am receiving and not grumble when my company announced freeze on wage increment days ago.

Internet Explorer 8.0

Microsoft has released their very new browser - Internet Explorer 8.0. So far, the public opinions on this new browser has been very positive.

What policymakers should know about "cloud computing"

Bob Boorstin, Director, Corporate and Policy Communications for Google, made a post on what policymakers should know about "cloud computing".

What policymakers should know about "cloud computing" [via]

What policymakers should know about "cloud computing" [via]

Gmail Labs: Undo Send

Google Gmail Labs has just come out with an innovative Undo Send email feature. This feature attempts to undo sending of an email after you click on "Send". However, you will need to do it quick within 5 seconds before the email is really being sent out.

New in Labs: Undo Send [via]

New in Labs: Undo Send [via]

Wednesday, March 18, 2009

Google Chrome 2.0 Beta

The best thing about this new beta is speed — it's 25% faster on our V8 benchmark and 35% faster on the Sunspider benchmark than the current stable channel version and almost twice as fast when compared to our original beta version.

Do remember to try the new drag tabs feature.

Google Chrome has a new beta [via]

Do remember to try the new drag tabs feature.

Google Chrome has a new beta [via]

Tuesday, March 17, 2009

8 Months Bonuses for CDC Staff Explained

Mr Lim Boon Heng, People's Association deputy chairman and Minister in the Prime Minister's Office, explains the reason why 2 staff from the Northwest Community Development Council (CDC) received 8 months bonuses last year below.

"In good times and in bad, there are good performers. And I think that particularly in bad times, we need people who give of their best and show example to the rest about what they can do to help the organisation."

CDC bonuses explained [via]

"In good times and in bad, there are good performers. And I think that particularly in bad times, we need people who give of their best and show example to the rest about what they can do to help the organisation."

CDC bonuses explained [via]

Top Up Of EZ-Link Cards At DBS And POSB ATMs

We are pleased to announce that DBS and EZ-Link Pte Ltd (EZL) have introduced a new ATM service at DBS and POSB ATMs – Top Up of ez-link cards. What’s more, the ez-link top up service will be available to the recently announced new (replacement) ez-link cards as well. We are also proud to inform that we are the first bank in Singapore to offer this service.

We will be piloting the service at 31 ATMs from 16 Jan 2009 onwards and will gradually roll out to over 900 DBS and POSB ATMs by end June 2009. (Please refer to Appendix 1 for the pilot ATM sites)

With it, DBS will be bringing greater convenience to the majority of commuters who are also our customers. We are also offering the service free of charge.

You may refer to attachment 2 for the ATM screen flow for this service.

Agnes Ang

CBG Business Operations

on behalf of Robin Yap

CBG Deposit Sys & Payment Scvs

Instructions

Pilot ATM Sites from 16 Jan 2009

We will be piloting the service at 31 ATMs from 16 Jan 2009 onwards and will gradually roll out to over 900 DBS and POSB ATMs by end June 2009. (Please refer to Appendix 1 for the pilot ATM sites)

With it, DBS will be bringing greater convenience to the majority of commuters who are also our customers. We are also offering the service free of charge.

You may refer to attachment 2 for the ATM screen flow for this service.

Agnes Ang

CBG Business Operations

on behalf of Robin Yap

CBG Deposit Sys & Payment Scvs

Instructions

Pilot ATM Sites from 16 Jan 2009

Monday, March 16, 2009

S'pore firms turn to cloud computing

Business Times - 16 Mar 2009

S'pore firms turn to cloud computing

Two studies show that there is a high level of interest in this cutting edge technology which can reduce capital expenditure and costs, reports AMIT ROY CHOUDHURY

CLOUD computing, which promises to reduce capital expenditure and operational costs, is being examined closely by Singaporean companies, two independent surveys have revealed.

Cloud computing refers to the delivery of services over the Internet by a service provider or vendor, with the 'cloud' referring to the Internet.

It is closely related to some of the technologies that chief information officers (CIOs)are most interested in, such as Software-as-a-Service (SaaS), utility computing and resource virtualisation.

According to IDC, in Singapore there is a high level of awareness of cloud computing, with nearly 80 per cent of companies surveyed saying that they knew about cloud computing.

However, another survey by Avanade shows that Singapore still lags behind the US in the adoption of cloud computing. Avanade is a leading technology integrator working on the Microsoft Enterprise platform.

The Avanade report noted that more than 60 per cent of the companies are not familiar with cloud computing and how it can benefits their organisation. Only about 10 per cent of the companies are beginning to test and use it.

IDC's findings broadly corroborates this last point. According to the research firm, 40 per cent Singaporean respondents said that the 'cloud' was either just vendor hype, renaming of an old concept or still too immature to judge its value.

Also, 30 per cent said that it was going to be a useful new service delivery model, with 20 per cent saying that they were either piloting or using cloud computing already.

IDC's Chris Morris told BizIT that there is much interest in cloud computing amongst both end-user and vendor communities in Singapore.

'Both see it as a way of reducing their costs of delivery, and funding expansion of services or new projects within now very constrained Capex (capital expenditure) budgets . . . That cloud works on an Opex (operational expenditure) basis with limited or no up-front charges is very attractive to them,' Mr Morris, who is IDC's Asia-Pacific research director for Services Research, said.

Avanade's Tia Too Seng added that about 60 per cent of Singaporean companies surveyed in their study believe that cloud computing is a real technology option and can help to reduce overall business cost.

'However, most companies are not embarking on the use of cloud computing yet because of their uncertainty over security of data, control and service level. Service providers and vendors will need to do more to educate and create the awareness and provide more assurance before the adoption rate will increase,' Mr Tia, Avanade's South-east Asia chief technology officer, told BizIT.

Mr Tia observed that with the current economic downturn and companies looking to lower their IT expenditure in Singapore, Avanade feels that more companies will seriously consider using cloud computing 'if they are more assured by service providers or vendors over security of data and service level'.

IDC's Mr Morris noted that in Singapore, 'there is a serious intention to counter recession through innovation with new technologies like cloud computing'.

Avanade's Mr Tia added that although his company hasn't yet seen a rush of companies implementing cloud computing in Singapore yet, there is certainly an increase in interest.

'There's no doubt that cloud computing has a compelling value proposition in helping companies to reduce their IT investments and build a flexible IT infrastructure,' Mr Tia said.

He added that given the present economic downturn, companies are looking to do more with less (investment) and some of these companies are starting to look at how to include cloud computing as part of their IT plans.

'Cloud computing does require a complete rethink of technology infrastructure and changes how companies make IT investments, hence our advice is for companies to plan and test out on a smaller scale before they leap into wider implementation.'

Singapore's public sector has shown a very high level of interest in cloud computing, according to IDC. Mr Morris noted that the public sector sees it as a way of reducing costs and delivering more and better services to their constituencies.

'The education sector is also particularly attracted to the cloud concept because of cost saving potential,' he added.

Market watchers with whom BizIT have spoken to in the past have said that the Singapore Ministry of Education's proposed outsourcing project for around 100,000 front-end computers is expected to include technologies such as cloud computing, especially for services such as e-mail.

Mr Tia noted that the Avanade survey did not see any significant differences among the different verticals among Singapore companies in their interests in cloud computing.

'We do, however, see a difference in the type of applications that they will consider using cloud computing for,' he added.

Regardless of verticals, companies do consider using cloud computing for applications that are 'commodity' in nature, for example e-mail, office applications, or even customer relationship management (CRM) applications, Mr Tia said.

However, the Singapore companies are generally not yet considering the more sophisticated applications that require higher level of security or control, the Avanade official noted.

According to IDC, worldwide IT spending on cloud services will grow almost threefold, reaching US$42 billion, by 2012.

The same survey shows that in Asia-Pacific excluding Japan (APEJ), 11 per cent of the respondents are already using cloud-based solutions.

A further 41 per cent indicated that they are either evaluating cloud solutions for use in their businesses, or already piloting cloud solutions.

When asked about their opinion of the current state of cloud computing, 17 per cent of the respondents stated that although cloud computing is very promising, there are currently not enough services available to make it compelling.

IDC's Mr Morris noted that future uptake of cloud computing looks strong in APEJ.

'Over the next three years, as the use of cloud services expand . . . it becomes critical for IT vendors to develop strong cloud offerings and play a leadership role in aligning their new cloud products and services with their traditional offerings, partner ecosystem, and customer and market requirements,' he said.

S'pore firms turn to cloud computing

Two studies show that there is a high level of interest in this cutting edge technology which can reduce capital expenditure and costs, reports AMIT ROY CHOUDHURY

CLOUD computing, which promises to reduce capital expenditure and operational costs, is being examined closely by Singaporean companies, two independent surveys have revealed.

Cloud computing refers to the delivery of services over the Internet by a service provider or vendor, with the 'cloud' referring to the Internet.

It is closely related to some of the technologies that chief information officers (CIOs)are most interested in, such as Software-as-a-Service (SaaS), utility computing and resource virtualisation.

According to IDC, in Singapore there is a high level of awareness of cloud computing, with nearly 80 per cent of companies surveyed saying that they knew about cloud computing.

However, another survey by Avanade shows that Singapore still lags behind the US in the adoption of cloud computing. Avanade is a leading technology integrator working on the Microsoft Enterprise platform.

The Avanade report noted that more than 60 per cent of the companies are not familiar with cloud computing and how it can benefits their organisation. Only about 10 per cent of the companies are beginning to test and use it.

IDC's findings broadly corroborates this last point. According to the research firm, 40 per cent Singaporean respondents said that the 'cloud' was either just vendor hype, renaming of an old concept or still too immature to judge its value.

Also, 30 per cent said that it was going to be a useful new service delivery model, with 20 per cent saying that they were either piloting or using cloud computing already.

IDC's Chris Morris told BizIT that there is much interest in cloud computing amongst both end-user and vendor communities in Singapore.

'Both see it as a way of reducing their costs of delivery, and funding expansion of services or new projects within now very constrained Capex (capital expenditure) budgets . . . That cloud works on an Opex (operational expenditure) basis with limited or no up-front charges is very attractive to them,' Mr Morris, who is IDC's Asia-Pacific research director for Services Research, said.

Avanade's Tia Too Seng added that about 60 per cent of Singaporean companies surveyed in their study believe that cloud computing is a real technology option and can help to reduce overall business cost.

'However, most companies are not embarking on the use of cloud computing yet because of their uncertainty over security of data, control and service level. Service providers and vendors will need to do more to educate and create the awareness and provide more assurance before the adoption rate will increase,' Mr Tia, Avanade's South-east Asia chief technology officer, told BizIT.

Mr Tia observed that with the current economic downturn and companies looking to lower their IT expenditure in Singapore, Avanade feels that more companies will seriously consider using cloud computing 'if they are more assured by service providers or vendors over security of data and service level'.

IDC's Mr Morris noted that in Singapore, 'there is a serious intention to counter recession through innovation with new technologies like cloud computing'.

Avanade's Mr Tia added that although his company hasn't yet seen a rush of companies implementing cloud computing in Singapore yet, there is certainly an increase in interest.

'There's no doubt that cloud computing has a compelling value proposition in helping companies to reduce their IT investments and build a flexible IT infrastructure,' Mr Tia said.

He added that given the present economic downturn, companies are looking to do more with less (investment) and some of these companies are starting to look at how to include cloud computing as part of their IT plans.

'Cloud computing does require a complete rethink of technology infrastructure and changes how companies make IT investments, hence our advice is for companies to plan and test out on a smaller scale before they leap into wider implementation.'

Singapore's public sector has shown a very high level of interest in cloud computing, according to IDC. Mr Morris noted that the public sector sees it as a way of reducing costs and delivering more and better services to their constituencies.

'The education sector is also particularly attracted to the cloud concept because of cost saving potential,' he added.

Market watchers with whom BizIT have spoken to in the past have said that the Singapore Ministry of Education's proposed outsourcing project for around 100,000 front-end computers is expected to include technologies such as cloud computing, especially for services such as e-mail.

Mr Tia noted that the Avanade survey did not see any significant differences among the different verticals among Singapore companies in their interests in cloud computing.

'We do, however, see a difference in the type of applications that they will consider using cloud computing for,' he added.

Regardless of verticals, companies do consider using cloud computing for applications that are 'commodity' in nature, for example e-mail, office applications, or even customer relationship management (CRM) applications, Mr Tia said.

However, the Singapore companies are generally not yet considering the more sophisticated applications that require higher level of security or control, the Avanade official noted.

According to IDC, worldwide IT spending on cloud services will grow almost threefold, reaching US$42 billion, by 2012.

The same survey shows that in Asia-Pacific excluding Japan (APEJ), 11 per cent of the respondents are already using cloud-based solutions.

A further 41 per cent indicated that they are either evaluating cloud solutions for use in their businesses, or already piloting cloud solutions.

When asked about their opinion of the current state of cloud computing, 17 per cent of the respondents stated that although cloud computing is very promising, there are currently not enough services available to make it compelling.

IDC's Mr Morris noted that future uptake of cloud computing looks strong in APEJ.

'Over the next three years, as the use of cloud services expand . . . it becomes critical for IT vendors to develop strong cloud offerings and play a leadership role in aligning their new cloud products and services with their traditional offerings, partner ecosystem, and customer and market requirements,' he said.

Sunday, March 15, 2009

Google, la machine à penser

The above video on Google is in French but the images in the video is good enough to reveal how it is like in Googleplex. Enjoy!

2 Staff from Northwest Community Development Council (CDC) Received 8 Months Bonuses Last Year

That is very good bonuses indeed!

Northwest CDC mayor says PA, WDA decide on staff pay, bonuses [via]

Northwest CDC mayor says PA, WDA decide on staff pay, bonuses [via]

Friday, March 13, 2009

Convert PDF to Word (DOC) Online

Using PDF-to-Word converter, you can quickly and easily create editable DOC/RTF files, making it a cinch to re-use PDF content in applications like Microsoft Word, Excel, OpenOffice, and WordPerfect.

Best of all, it's entirely free!

Convert PDF to Word (DOC) Online [via]

Best of all, it's entirely free!

Convert PDF to Word (DOC) Online [via]

Thursday, March 12, 2009

Support for NUS Student With Leukemia

A student of the National University of Singapore, Ms Zhang Xiaoou (Matric Card Number: U052101M) has recently been diagnosed with Acute Lymphocytic Leukemia (ALL), a life-threatening disease that will post a staggering SGD$400,000 medical bill to her middle-income family.

She is a 24 year old Chinese scholar in her final year of study in Faculty of Science with excellent academic result. In her undergraduate education, she was placed several times on the Dean’s List which is awarded to the top 5% students only.

Xiaoou is also an active student leader in various schools and social activates. She was the Vice Chairperson of NUS Students’ Union Welfare Standing Committee and volunteered as a teaching assistant for community service project – “GIVE”.

She is currently undergoing treatment in National University Hospital and she will need a prolonged period of chemotherapy for treatment of her leukemia. Her medical expenses are estimated to be SGD$400,000, with each treatment session around $50,000. Her mother is unemployed and her dad earns a monthly income of SGD$400.

Donation Booths on Campus from 11th to 13th March:

Engineering LT7A & LT6, 10am-6pm

Science LT26, 10am-6pm

You may contact two of Xiaoou’s friends who will be assisting in this. Following are their contact details:

1. Guan Dian | guandian0527@gmail.com or guandian@nus.edu.sg | 9723 6737

2. Han Si | catherine9116@hotmail.com or u0509390@nus.edu.sg | 9116 0584

For more updates on Xiaoou, please visit:

http://blog.sina.com.cn/blessxiaoou

We sincerely appeal to all of you reading this note for your kindest support, be it donations or prayers, to help save the life and dream of this student in NUS.

Thank you very much.

The Executive Committee of 2008/09

Graduate Students’ Society

National University of Singapore

She is a 24 year old Chinese scholar in her final year of study in Faculty of Science with excellent academic result. In her undergraduate education, she was placed several times on the Dean’s List which is awarded to the top 5% students only.

Xiaoou is also an active student leader in various schools and social activates. She was the Vice Chairperson of NUS Students’ Union Welfare Standing Committee and volunteered as a teaching assistant for community service project – “GIVE”.

She is currently undergoing treatment in National University Hospital and she will need a prolonged period of chemotherapy for treatment of her leukemia. Her medical expenses are estimated to be SGD$400,000, with each treatment session around $50,000. Her mother is unemployed and her dad earns a monthly income of SGD$400.

Donation Booths on Campus from 11th to 13th March:

Engineering LT7A & LT6, 10am-6pm

Science LT26, 10am-6pm

You may contact two of Xiaoou’s friends who will be assisting in this. Following are their contact details:

1. Guan Dian | guandian0527@gmail.com or guandian@nus.edu.sg | 9723 6737

2. Han Si | catherine9116@hotmail.com or u0509390@nus.edu.sg | 9116 0584

For more updates on Xiaoou, please visit:

http://blog.sina.com.cn/blessxiaoou

We sincerely appeal to all of you reading this note for your kindest support, be it donations or prayers, to help save the life and dream of this student in NUS.

Thank you very much.

The Executive Committee of 2008/09

Graduate Students’ Society

National University of Singapore

Forbes - The World's Billionaires 2009

Last year the world had 1,125 billionaires but today, there are only 793. Today the world's billionaires have a collective net worth of $2.4 trillion, down $2 trillion from a year ago.

- William Gates III

- Warren Buffett

- Carlos Slim Helú

- Lawrence Ellison

- Ingvar Kamprad

- Karl Albrecht

- Mukesh Ambani

- Lakshmi Mittal

- Theo Albrecht

- Amancio Ortega

- Jim Walton

- Alice Walton

- Christy Walton

- S Robson Walton

- Bernard Arnault

- Li Ka-shing

- Michael Bloomberg

- Stefan Persson

- Charles Koch

- David Koch

German Prince Replaces Facebook Zuckerberg as Youngest Billionaire

Facebook founder, Mark Zuckerberg, who's just shy of his 25th birthday, has lost his world's youngest billionaire title to German prince Albert von Thurn und Taxis because he's not a billionaire anymore.

An article from the CNET says Zuckerberg title has been replaced by a guy with the worst sideburns ever seen.

An article from the CNET says Zuckerberg title has been replaced by a guy with the worst sideburns ever seen.

The World's Youngest Billionaires [via]

An article from the CNET says Zuckerberg title has been replaced by a guy with the worst sideburns ever seen.

An article from the CNET says Zuckerberg title has been replaced by a guy with the worst sideburns ever seen.The World's Youngest Billionaires [via]

Wednesday, March 11, 2009

The Reason Behind Why Internet Radio is Down These Days

Is it RIP for Singapore internet radio?

By Mayo Martin, TODAY | Posted: 11 March 2009 0940 hrs

SINGAPORE: She lives in China, yet it’s a family of familiar voices from Singapore that have kept Jennifer Seah informed and entertained.

For the past two-and-a-half years, the Singapore housewife, whose husband works in Shanghai, has been tuning into MediaCorp’s Internet radio streaming service which has been online since 2000.

“It’s wonderful to be able to tune in to familiar voices from home when you are abroad,” she told Today. So she was very disappointed when, earlier this month, most of the Internet radio streamed out of Singapore suddenly went offline.

The reason: It is going to cost broadcasters thousands, if not hundreds of thousands, of dollars each year in licence fees depending on the number of stations they operate.

After an amendment to the Copyright Act in December, broadcasters here have been locked in talks with the Recording Industry Performance Singapore (RIPS).

RIPS is the collective licensing body of 13 record companies that issue licences to broadcast music. The new fees come at a time when the global economy is in turmoil and advertising, the lifeline of media companies, has been badly impacted.

A MediaCorp spokesperson explained to Today that, previously, radio stations were exempted from paying record companies when the songs played over the Internet were part of a radio simulcast, but now this exception only applies to broadcasts over the airwaves.

“The service will be resumed if we can come to an agreement with RIPS,” said the MediaCorp spokesperson. “We have received feedback from Singaporeans tuning in from overseas as well. The public have been concerned and requested to know the reasons behind the cessation.”

So far, MediaCorp’s 18 radio stations as well as Safra Radio’s two stations — Power98 and 88.3JIA FM — have stopped their Internet radio streaming service.

Sources told Today that SPH UnionWorks, which operates Radio 91.3 and Radio 100.3, is still in talks with RIPS and has a few more days to reach an agreement on the new licence fees. Mr Jamie Meldrum, 39, programme director for Radio 91.3 declined to comment, citing the fact that negotiations were still ongoing.

In the United States, the debate over royalty fees for online radio streaming has raged for years with commentators lamenting that the fees will one day kill Internet radio. A day Mrs Seah hopes she will not witness. “I hope the streaming service will come back soon and be even better,” she said. -TODAY

Is it RIP for Singapore internet radio? [via]

By Mayo Martin, TODAY | Posted: 11 March 2009 0940 hrs

SINGAPORE: She lives in China, yet it’s a family of familiar voices from Singapore that have kept Jennifer Seah informed and entertained.

For the past two-and-a-half years, the Singapore housewife, whose husband works in Shanghai, has been tuning into MediaCorp’s Internet radio streaming service which has been online since 2000.

“It’s wonderful to be able to tune in to familiar voices from home when you are abroad,” she told Today. So she was very disappointed when, earlier this month, most of the Internet radio streamed out of Singapore suddenly went offline.

The reason: It is going to cost broadcasters thousands, if not hundreds of thousands, of dollars each year in licence fees depending on the number of stations they operate.

After an amendment to the Copyright Act in December, broadcasters here have been locked in talks with the Recording Industry Performance Singapore (RIPS).

RIPS is the collective licensing body of 13 record companies that issue licences to broadcast music. The new fees come at a time when the global economy is in turmoil and advertising, the lifeline of media companies, has been badly impacted.

A MediaCorp spokesperson explained to Today that, previously, radio stations were exempted from paying record companies when the songs played over the Internet were part of a radio simulcast, but now this exception only applies to broadcasts over the airwaves.

“The service will be resumed if we can come to an agreement with RIPS,” said the MediaCorp spokesperson. “We have received feedback from Singaporeans tuning in from overseas as well. The public have been concerned and requested to know the reasons behind the cessation.”

So far, MediaCorp’s 18 radio stations as well as Safra Radio’s two stations — Power98 and 88.3JIA FM — have stopped their Internet radio streaming service.

Sources told Today that SPH UnionWorks, which operates Radio 91.3 and Radio 100.3, is still in talks with RIPS and has a few more days to reach an agreement on the new licence fees. Mr Jamie Meldrum, 39, programme director for Radio 91.3 declined to comment, citing the fact that negotiations were still ongoing.

In the United States, the debate over royalty fees for online radio streaming has raged for years with commentators lamenting that the fees will one day kill Internet radio. A day Mrs Seah hopes she will not witness. “I hope the streaming service will come back soon and be even better,” she said. -TODAY

Is it RIP for Singapore internet radio? [via]

Help Me Do a Survey

I am currently doing a research on the music industry and the impact of online music on the recording industry. As part of my research, I am conducting a survey and I would appreciate if you can help me out in doing the below survey.

The survey consists of 15 simple questions and should take you less than 10 minutes to complete. Be rest assured that your privacy is respected and your identity is anonymous. The questions are not sensitive anyway.

There is no need to let me know if you have done the survey. Just do it for I know you will.

The Survey

http://www.comp.nus.edu.sg/~lohhonch/survey.html

The survey consists of 15 simple questions and should take you less than 10 minutes to complete. Be rest assured that your privacy is respected and your identity is anonymous. The questions are not sensitive anyway.

There is no need to let me know if you have done the survey. Just do it for I know you will.

The Survey

http://www.comp.nus.edu.sg/~lohhonch/survey.html

Google Apps Status Dashboard - Service Status At a Glance

The next time you encounter problems accessing a service by Google, you may wish to visit Google's App Status Dashboard for an overall health status of Google's services.

Gmail experienced the latest service disruption.

Gmail experienced the latest service disruption.

Google App Status Dashboard [via]

Gmail experienced the latest service disruption.

Gmail experienced the latest service disruption.Google App Status Dashboard [via]

Tuesday, March 10, 2009

Singapore Jump to Become 10th Most Expensive Cities to Live In

According to a report by Economist Intelligence Unit (EIU), Singapore has become the 10th most expensive city to live in.

West European cities still dominate the top ten worldwide, with just three cities (Tokyo, Osaka and Singapore) from outside Europe. Hong Kong is ranked 11th.

Most Expensive and Cheapest Cities to Live In [via]

West European cities still dominate the top ten worldwide, with just three cities (Tokyo, Osaka and Singapore) from outside Europe. Hong Kong is ranked 11th.

Most Expensive and Cheapest Cities to Live In [via]

Usability Practice Cognitive View: Strategies For Designing Application Navigation

THE COGNITIVE VIEW

Getting the navigation right is one of the most important aspects of design. Navigation is the framework within which screens, interaction, and the visual appearance are designed. The most basic axiom of usability is that one should make interaction with the software as easy as possible, allowing users to focus on the tasks that brought them to the software in the first place. To the extent that navigation is confusing and requires the user's attention to figure it out, usability will suffer.

Usability in Practice: Strategies For Designing Application Navigation [via]

Getting the navigation right is one of the most important aspects of design. Navigation is the framework within which screens, interaction, and the visual appearance are designed. The most basic axiom of usability is that one should make interaction with the software as easy as possible, allowing users to focus on the tasks that brought them to the software in the first place. To the extent that navigation is confusing and requires the user's attention to figure it out, usability will suffer.

Usability in Practice: Strategies For Designing Application Navigation [via]

Monday, March 09, 2009

Budget Airline Ryanair Considers "Pay-Per-Poo"

IRISH budget airline Ryanair is considering charging passengers to use the toilet on its flights. The "pay-per-poo" scheme if kicked off will cost 1 pound "per-poo". This poo trip on high altitude is indeed very costly.

Budget airline mulls charging passengers to use toilet [via]

Budget airline mulls charging passengers to use toilet [via]

Sunday, March 08, 2009

Saturday, March 07, 2009

Deaths of David Hartanto Widjaja and Zhou Zheng - A Conspiracy Theory on Deaths in NTU

2 deaths in Nanyang Technological University in under 1 week is indeed not helpful to NTU's reputation. The first death was a student, David Hartanto Widjaja, and the second one was a Project Officer Officer, Zhou Zheng.

By coincidence or not by coincidence, both are actually from the same laboratory (S2-B3a-06)!

A consipracy theory on deaths in NTU [via]

By coincidence or not by coincidence, both are actually from the same laboratory (S2-B3a-06)!

A consipracy theory on deaths in NTU [via]

Internet Explorer 8 can be removed from Windows 7

The next Microsoft's operating system Windows 7 is offering users option to "remove" Internet Explorer 8 from the OS. This could be a reaction from Microsoft to avoid another lawsuit by the European Union (EU).

Internet Explorer 8 can be removed from Windows 7 [via]

Internet Explorer 8 can be removed from Windows 7 [via]

Friday, March 06, 2009

Singapore tops international e-Government survey

Singapore has overtaken the United States to come out tops in an international e-Government study. If I remember correctly, Singapore was already the top in a separate survey by Accenture in year 2007.

I believe the Singapore IT landscape will even be better than now with the current SOE (Standard ICT Operating Environment) and IDA's iN2015 plan.

Singapore tops international e-Government survey [via]

I believe the Singapore IT landscape will even be better than now with the current SOE (Standard ICT Operating Environment) and IDA's iN2015 plan.

Singapore tops international e-Government survey [via]

Bad news can be good news for investors

Buying into the stock market one month after the worst GDP contraction produces a return of 21% in three months, 38% in six months and 53% in 12 months.

Business Times - 06 Mar 2009

Bad news can be good news for investors

By ARTHUR SIM

THE revelation that the economy could shrink a shocking 10 per cent this year could be just the news that some investors have been waiting for.

Citing poor economic data - manufacturing and non-oil domestic exports have fallen by around 30 per cent and 35 per cent from their peaks respectively - Citigroup said that it believes that Q109 could possibly see gross domestic product (GDP) shrink by 10 per cent, followed by 8 per cent in Q209.

However, Citigroup believed that this could be an indication that the time to start buying into the stock market is nigh.

Timing, however, will be critical. While buying into the stock market during recessions can produce exceptional returns, it can be counter-productive if the investment horizon is short (eg three months), said Citigroup.

But looking at the four past recessions, it noted that buying one or two months after the quarter of the worst GDP contraction in past recessions produces positive and more consistent returns.

By back-testing the strategy, it found that buying one month after the worst GDP contraction would produce a return of 21 per cent in three months, 38 per cent in six months and 53 per cent in 12 months (with the exception of one period - the 1985/1986 recession - in which there was a negative three-month return of 3 per cent).

Of course, it is not known if Q109 will register the steepest GDP contraction during this current downturn.

But it seems that recent data has been so bad that it can only get better.

In its report, Citigroup said: 'We see no sure signs that manufacturing or exports will rebound in a definite fashion as yet, judging from recent leading indicators, although we see some signs of stabilisation.'

Looking at various economic indicators around the world, Citigroup head of Singapore research Chua Hak Bin added: 'Key indicators are showing some uptick.'

He also reckoned that the scenario where exports fall to a level that would suggest an 8 per cent or even a 10 per cent GDP contraction is not likely. 'The level of contraction is already fairly steep,' he added.

Citigroup said that the sectors that will outperform in the recovery phase of this current recession will very much depend on the nature of this recovery - whether led by China, or infrastructure spending, or new areas of technological innovation.

In the past recessions, different sectors led the recovery. In the 1998 Asian crisis, banks, developers and transport led the recovery.

In the 2001 tech recession, transport, financials and media led the recovery while in the 2003 Sars recession, developers and conglomerates led the recovery on the commodity boom and growth in the high-end market.

Bad news can be good news for investors [via]

Business Times - 06 Mar 2009

Bad news can be good news for investors

By ARTHUR SIM

THE revelation that the economy could shrink a shocking 10 per cent this year could be just the news that some investors have been waiting for.

Citing poor economic data - manufacturing and non-oil domestic exports have fallen by around 30 per cent and 35 per cent from their peaks respectively - Citigroup said that it believes that Q109 could possibly see gross domestic product (GDP) shrink by 10 per cent, followed by 8 per cent in Q209.

However, Citigroup believed that this could be an indication that the time to start buying into the stock market is nigh.

Timing, however, will be critical. While buying into the stock market during recessions can produce exceptional returns, it can be counter-productive if the investment horizon is short (eg three months), said Citigroup.

But looking at the four past recessions, it noted that buying one or two months after the quarter of the worst GDP contraction in past recessions produces positive and more consistent returns.

By back-testing the strategy, it found that buying one month after the worst GDP contraction would produce a return of 21 per cent in three months, 38 per cent in six months and 53 per cent in 12 months (with the exception of one period - the 1985/1986 recession - in which there was a negative three-month return of 3 per cent).

Of course, it is not known if Q109 will register the steepest GDP contraction during this current downturn.

But it seems that recent data has been so bad that it can only get better.

In its report, Citigroup said: 'We see no sure signs that manufacturing or exports will rebound in a definite fashion as yet, judging from recent leading indicators, although we see some signs of stabilisation.'

Looking at various economic indicators around the world, Citigroup head of Singapore research Chua Hak Bin added: 'Key indicators are showing some uptick.'

He also reckoned that the scenario where exports fall to a level that would suggest an 8 per cent or even a 10 per cent GDP contraction is not likely. 'The level of contraction is already fairly steep,' he added.

Citigroup said that the sectors that will outperform in the recovery phase of this current recession will very much depend on the nature of this recovery - whether led by China, or infrastructure spending, or new areas of technological innovation.

In the past recessions, different sectors led the recovery. In the 1998 Asian crisis, banks, developers and transport led the recovery.

In the 2001 tech recession, transport, financials and media led the recovery while in the 2003 Sars recession, developers and conglomerates led the recovery on the commodity boom and growth in the high-end market.

Bad news can be good news for investors [via]

Wednesday, March 04, 2009

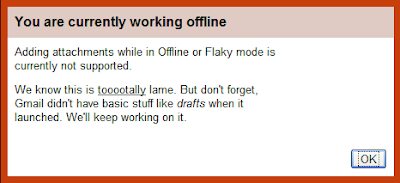

Offline Gmail Does Not Support File Attachments When Composing

Offline Gmail does not support file attachments when composing an email. When you click on "Attach a file", you will see the above message.

Offline Gmail does not support file attachments when composing an email. When you click on "Attach a file", you will see the above message.

What's Your Peak Work Time?

My peak work time is in the midnight and I am not alone. A survey conducted by LifeHacker had over 30% voters voting for "Late at night". A very small 3% voted for "Noon".

As of now, the votes are as above.

As of now, the votes are as above.

What's Your Peak Work Time? [via]

As of now, the votes are as above.

As of now, the votes are as above.What's Your Peak Work Time? [via]

Asteroid zooms by earth, cutting it close

An asteroid estimated to be between 30 and 50 meters wide, 60,000 kilometers away from Earth, was several times closer to Earth than the moon when it passed (the moon is about 240,000 miles away). This happened on a Monday.

What a close shave!

Asteroid zooms by earth, cutting it close [via]

What a close shave!

Asteroid zooms by earth, cutting it close [via]

Tuesday, March 03, 2009

MayBank iSavvy Savings Interest Rates Revised Downwards

Both MayBank has revised interest rates for their deposits accounts in line with all other banks operating in Singapore.

MayBank iSavvy Savings Account Interest Rate Revision [via]

Standard Chartered e$aver Account Current Interest Rate [via]

MayBank iSavvy Savings Account Interest Rate Revision [via]

Daily balance below S$5,000 0.25% p.a unchangedEffective from 3 March 2009

Daily balance of S$5,000 to below S$50,000 0.50% p.a from 1.08%

Daily balance of S$50,000 and above 0.75% p.a from 1.38%

Standard Chartered e$aver Account Current Interest Rate [via]

Less than S$50,000 0.40% p.a.My previous post on e$aver and iSavvy [via]

S$50,000 to S$199,999 0.68% p.a.

S$200,000 & above 0.88% p.a.

Another Joke from NTUC Union Chief and Minister for PMO, Lim Swee Say

House had 89 MPs, not 93, on Feb 5

The Straits Times

3 Mar 2009

I REFER to my reply last Saturday, 'Duties taken seriously'.

I said in the letter: 'This year's Budget Debate was attended by 90 elected and Nominated MPs on Feb 3; 86 MPs on Feb 4; and there was full attendance of 93 MPs on Feb 5.'

While the numbers for Feb 3 and Feb 4 are correct, Parliament has advised that there is an error in the number for Feb 5. It should be 89 and not 93.

My apologies for the error which was due to a miscommunication between the Whip and Parliament.

Lim Swee Say

Government Whip

House had 89 MPs, not 93, on Feb 5 [via]

The Straits Times

3 Mar 2009

I REFER to my reply last Saturday, 'Duties taken seriously'.

I said in the letter: 'This year's Budget Debate was attended by 90 elected and Nominated MPs on Feb 3; 86 MPs on Feb 4; and there was full attendance of 93 MPs on Feb 5.'

While the numbers for Feb 3 and Feb 4 are correct, Parliament has advised that there is an error in the number for Feb 5. It should be 89 and not 93.

My apologies for the error which was due to a miscommunication between the Whip and Parliament.

Lim Swee Say

Government Whip

House had 89 MPs, not 93, on Feb 5 [via]

Monday, March 02, 2009

DBS/POSB Deposits Interest Rates Revision

Interest rates for DBS Bank savings plan has now gone south all the way to 0.125% p.a. I have decided to move to other banks and not DBS or POSB since 2 years ago.

DBS Deposits Interest Rates

http://www.dbs.com/sg/personal/deposit/notice/interest_rates/pages/default.aspx

POSB Deposits Interest Rates

http://www.dbs.com/posb/deposit/notice/interest_rates/Pages/default.aspx

DBS Deposits Interest Rates

http://www.dbs.com/sg/personal/deposit/notice/interest_rates/pages/default.aspx

POSB Deposits Interest Rates

http://www.dbs.com/posb/deposit/notice/interest_rates/Pages/default.aspx

Subscribe to:

Posts (Atom)

Popular Posts

-

I would like to apologize that sigining of my guestbook is not possible at the moment due to an unexpected bug. There is already 74 entries ...

-

Singapore's Land Transport Authority has just released an updated official MRT map including one additional station on the Downtown Line...

-

*********** Try to sleep now, close your eyes Soon the birds would stop singing Twinkling stars, are shining bright They'll be watch...

-

Installed FortiClient recently but the challenge in disabling the application/service from running automatically on every start-up annoyed m...

-

POLLING Day next Saturday will be a public holiday as Singaporeans go to the polls to cast their votes in Singapore's 11th General Elect...